Innovation Activities in India's IT Industry:

Status Quo and Emerging Trends

Opportunities for Innovation Collaborations and Global Competence Centres

[ By Rajnish Tiwari ]

[ Download Project Proposal as PDF, 87 KB]

[Background] [Moving Upstream in the Value-chain ] [Research Focus] [Methodology] [Objectives]

A project of:

Project Team:

Start: May 15, 2007

Proposed duration: six months

Project Advisor: Prof. Cornelius Herstatt (Director, TIM/TUHH)

Background

Few, if any, industry sectors have single-handedly contributed to the growth of an economy as decisively as the Information Technology (IT) sector has done to India’s. Within a remarkably short time India’s IT sector has advanced from being a non-entity just less than 15 years back to the status of a vital industry sector of international significance, which has been registering an annual compound growth rate (ACGR) of about 28% for the past decade or so.

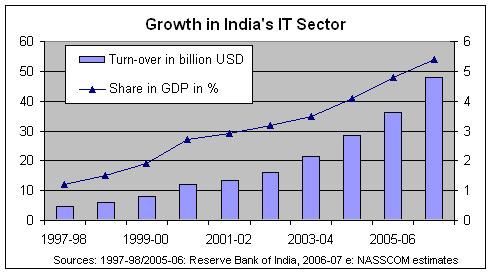

The contribution of the IT sector to India’s Gross Domestic Product (GDP) has registered an impressive growth. According to Reserve Bank of India (RBI) the contribution of IT sector to India’s GDP rose from about 2% at the turn of the millennium to 4.8% at the end of fiscal year 2005-06 (April-March). According to NASSCOM, India’s IT association, share of IT industry in India’s GDP is estimated to reach 5.4% in 2006-07 [NASSCOM, 2007]. The growth is even more impressive considering the fact that India’s GDP has itself been growing well over 6% per annum (p.a.) in this period. Figure 1 illustrates the impact of IT sector on the economy.

Figure 1: Growth of India’s IT Sector and its Contribution to GDP in a Fiscal Year

According to an estimate by NASSCOM, India’s IT industry is estimated to comprise of 47.8 billion US dollars at the end of fiscal year 2006-07, more than doubling within 2 years from 21.6 billion USD at the end of fiscal year 2004-05. It provides employment to some 1.6 million individuals. The revenues are expected to reach 148 billion USD by 2012, with exports constituting a major chunk.

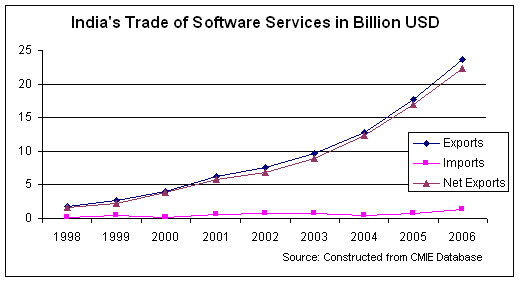

The major contributor to India’s software success has been the software services sector. Using highly skilled labour as the major input with relatively little capital, Indian firms could satisfy the foreign clientele (mainly US and other industrialized countries in Western Europe) with cost effective IT solutions. It accounts for the lion's share (nearly 80%) of India's IT sector.

In turn, about 80% of the revenues in the software sector are generated by exporting IT services. Exports are estimated to account for 31.3 billion USD out of 39.7 billion USD turn-over in fiscal year 2006-07 [NASSCOM, 2007]. The software sector has emerged as the prime driver of the overall foreign exchange reserve. It meanwhile consists of nearly 80% of the IT sector in India. Figure 2 shows the impressive export growth in software services in a given calendar year.

Figure 2: India’s Trade of Software Services in Million USD in a Calendar year

India is also home to some of the most renowned IT firms. While India’s own Infosys, Tata Consultancy Services (TCS), Wipro, and Stayam are growing into the role of “global players”, world’s leading players are entering India in a big way. All major names such as Microsoft, Oracle, IBM and SAP meanwhile maintain a significant presence in India. For some firms India has become their biggest operation worldwide employing more people than even the headquarters; for some others their Indian operation in software development is the only one of its kind outside their own home market.

Moving Upstream in the Value-chain

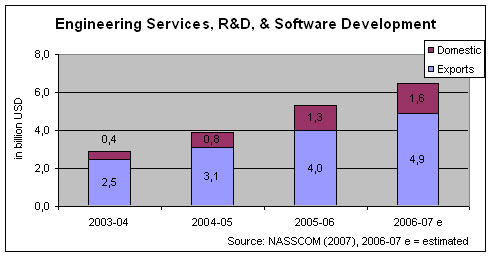

Despite the rapid growth, experts have attributed the success of India’s IT sector and especially of its software firms mainly to outsourcing services to multinational firms for low-value, routine and standardized tasks such as data entry or call-centre services. Lately shift has been observed towards a high-value segment of research and development (R&D) works, such as software development, engineering services, and product design.

Figure 3: India’s Revenues in High-end Services

The number of employees engaged in the high-end segment increased by 78% in the same period, from 81,000 in 2003-04 to 144,000 in 2006-07. The significant increase in the revenues generated, as well as in employment provided, by engineering services, R&D, and software development points to the shift mentioned above. Interestingly enough the domestic share of these services quadruplicated from just 0.4 billion USD in 2004-05 to 1.6 billion USD in 2006-07 [NASSCOM, 2007]. According to a study by Booz Allen Hamilton, India, which currently holds a share of 12% in offshore engineering services, is expected to corner 30% share in the 1.1 trillion USD global spending on engineering services by 2020 [Business Line, 2006].

These developments point towards an increasing innovative role of Indian IT firms in the global value chain. On the other hand they also suggest the increasing demand for value-added products and/or services in the domestic market.

Research Focus

Even though there have been studies that suggest that India-based IT firms (both with Indian or foreign ownership) are indulging in innovation activities in a remarkable manner. This is confirmed by studies such as those by Bhattacharya et al [2006] and Ernst [2005 and 2006].

Nonetheless, research on the role of India’s IT sector in the high-end global value-chain has largely remained obscure. Most of the research thus far has focused on outsourcing of routine tasks and call-centre jobs. A primary reason for this research gap has been the lack of the lime-light on this segment, as India-based IT firms often provide only a part of the larger solution, which is developed elsewhere. Indian IT firms are generally involved in “contract R&D” whereas their foreign-owned counterparts in India tend to work as one of the many competence centres. This situation often leads to a lack of “external” appreciation and recognition by the media.

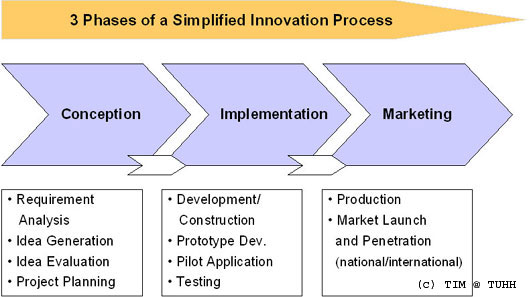

Our project intends to fill this research gap by investigating innovation activities in India’s software sector, spanning across the whole “innovation process”, beginning with the idea generation and ending with the commercialisation of the product/service developed. Figure 4 provides a brief and simplified overview of the innovation process, which builds the research guideline for this project.

Figure 4: Three Phases of a Simplified Innovation Process

Methodology

It is proposed to conduct an in-depth survey of India’s IT sector encompassing both domestically and foreign-owned enterprises. On the basis of expert interviews in primary IT hubs, Bangalore, Hyderabad, Mumbai, Pune, NOIDA, and Gurgaon, we intend to generate first-hand information on the status-quo of innovation activities and emerging trends in India’s IT sector.

The results of these semi-structured interviews would be complied and compared against known “barriers to innovation” in industrialized economies, especially Germany.

Objectives

A primary objective of this project is to understand the role and status of innovation in India’s IT sector, especially software industry, so as to assess emerging trends in this field. Since “innovation capacity” is increasingly considered to be crucial for staying competitive in today’s “globalized” world [see, Tiwari et al, 2007], our project is expected to provide vital clues on where India’s IT sector is standing and will be able to show what measures, if any, might be useful to retain and strengthen the unique, world-wide competitiveness it currently enjoys.

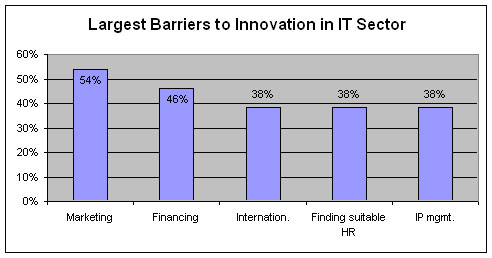

On the other hand it will also help the global community better understand chances and challenges of India operations in knowledge-intensive sectors. In a global world with mutually interdependent economies it will work to mutual, even multilateral, advantage. For instance, a study conducted by TIM/TUHH in Germany revealed certain “barriers to innovation” which may be overcome by forging close cooperation with international partners from the industry and academia, or setting up own global R&D facilities. The study was conducted by TIM/TUHH on behalf of the Hamburg State Ministry of Economic and Labour Affairs and was a part of the EU project “Regional Innovation Strategies” (RIS) to identify and remove barriers to innovation in Small- and Medium-sized Enterprises (SMEs). The study concentrated on certain key-industries in the Metropolitan Region of Hamburg. The results of the study are set to be published by this summer (2007).

Figure 5: Barriers to Innovation in IT Sector in Metropolitan Region of Hamburg

India, with its proven base of scientific capabilities, existing and emerging clusters in the high-tech sectors, positive demographic factors, and political stability with democratic system and independent judiciary might be an attractive location for innovation activities. This study, on a second plane, intends to examine these aspects of India from a global perspective.

This study is carried out under the aegis of the “Research Project Global Innovation” (RPGI) launched by TIM/TUHH, which is joined by NISTADS as cooperation partner. The study constitutes a part of the following projects at RPGI:

References

Bhattacharya, S., et al (2006) : “Indian Patenting Activity in International and Domestic Patent System: Contemporary Scenario”, Study by National Institute of Science, Technology and Development Studies (NISTADS), New Delhi , online available under: http://nistads.res.in

Business Line (2006) : “Offshore engg services is the next big thing”, 04.08.2006.

Ernst, D. (2005) : “Complexity and Internationalisation of Innovation - Why is Chip Design Moving to Asia?”, in: International Journal of Innovation Management, special issue in honour of Keith Pavitt , Vol. 9, No.1, March 2005.

Ernst, D. (2006) : “Innovation Offshoring: Asia ’s Emerging Role in Global Innovation Networks”, East West Center Special Reports, No. 10, July 2006.

NASSCOM (2007) : “Indian IT industry: NASSCOM Analysis”, online: http://www.nasscom.in/upload/5216/Indian_IT_Industry_Factsheet_Feb2007.pdf, retrieved: 22.02.2007

RBI (2006) : “Reserve Bank of India Annual Report 2005-06”, Mumbai.

Tiwari, R., Buse, S., and Herstatt, C. (2006) : “Innovation via Global Route : Proposing a Reference Model for Chances and Challenges of Global Innovation Processes”, forthcoming.

[ Download Project Proposal as PDF, 87 KB]

For any information, please contact:

Rajnish Tiwari

|

Startseite Deutsch | Search | Publications

Startseite Deutsch | Search | Publications